The Government Debt Is Best Described as

Government debt also known as public debt is any money or credit owed by any level of government. CThere was no change to the debt.

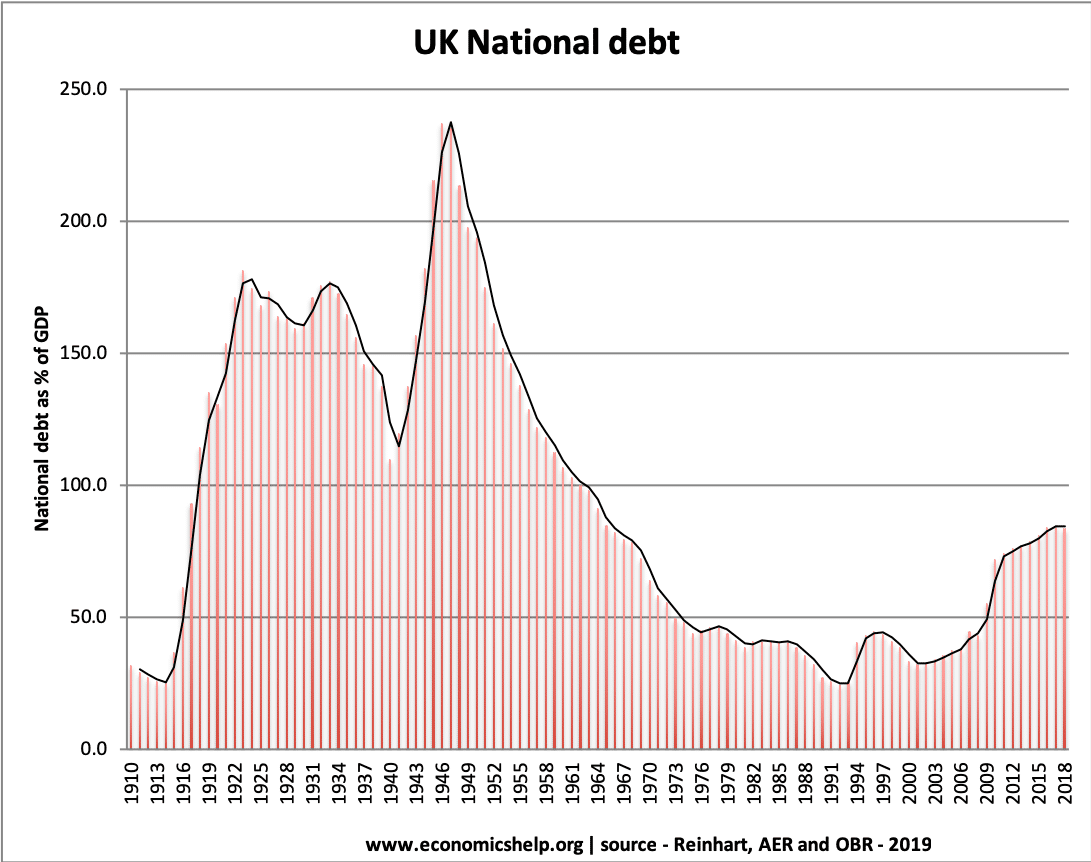

Uk National Debt Economics Help

The percentage of gross domestic product GDP needed to finance a countrys investment.

. Security which is backed by the full faith credit and taxing power of the US. Governments issue such debt any time they chose to borrow money from the public or from overseas nations and companies. Percentage of GDP needed to finance a countrys investment.

Corporation or trust through which investors pool their money in order to obtain diversification and professional management B. Those countries with higher levels of debt are often at risk for. Treasury Department or backed by the full faith and credit of the United States.

The national debt is best described as the. C risk of loss resulting from the issuer failing to make full and timely payments. National debt is made up of two types of debt.

The value of all US. The amount by which this years federal spending exceeds its taxes. Credit risk of a corporate bond is best described as the.

A pass through certificate is best described as a. B probability that the issuer fails to make full and timely payments. DThe debt went up.

Understanding government debt is a good way to understand the economy of a nation within a global context. The public national debt is best described as. Its also called sovereign debt country debt or government debt.

2 Currently there is over 17 trillion in debt outstanding. C The public debt. Government Debt means evidence of Debt issued or guaranteed by the United States Government or any agency thereof.

If the government currently has a budget deficit government expenditures must be less than taxes. AThe debt gradually decreased. As a government borrows this money it provides government securities that give all of the important.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. It begins by discussing the data on debt and deficits including the historical time series measurement issues and projections of future fiscal policy. Treasury bonds owned by foreigners.

State and local government including their pension funds 984 billion. This exchange is best described as. Sum of all federal budget deficits past and present.

Government debt or national debt is the accumulation of each years deficit. Below are the Schedules of Federal Debt and the accompanying notes as audited by the Government Accountability Office GAO going back to 1997. Government debt refers to the total amount of government issued IOUs which have not been paid back at any given point.

Government debt is typically measured as the gross debt of the general government sector that is in the form of liabilities that are debt instruments. Correct answer a BThe debt gradually increased. If the government currently has a budget deficit national savings must be increasing.

Which statement best describes the relationship between government deficit and government debt. A risk that an issuers creditworthiness deteriorates. According to the crowding out effect if the government sells bonds to.

Security which is backed by real property andor a lien on real estate. Federal government eliminate long-standing budget deficits and begin running budget surpluses. Debt held by the public and intragovernmental debt.

Which statement describes the federal government debt during Clintons two terms as president from 1993 to 2001. The public debt D Government spending. Private pension funds 600 billion.

Federal Reserve 246 trillion. The model captures the dynamic interactions between economic. Lowers consumption in the short run but raises it in the long run.

Mutual funds 18 trillion. Debt and Japan owned 103 trillion. The sum of all federal budget deficits past and present.

This paper surveys the literature on the macroeconomic effects of government debt. B monetizing the debt. According to the International Institute of Finance IIF public debt will reach USD70 trillion in 2019 up from USD657 trillion in 2018.

207 A debt instrument is a financial claim that requires payment of interest andor principal by the debtor to the creditor in the future. Value of all U. C an activity that lies outside of the limits set by Congress.

Debt market is the largest and most active trading market in the world. Debt held by the public is what the government owes to Treasury investors. Government Debt means Freely Transferable Indebtedness issued by the US.

Government debt public debt or national debt represent the amount of money borrowed by the government. Treasury bonds owned by foreigners. The paper then presents the.

Raises consumption in the short run but lowers it in the long run. Amount by which this years federal spending exceeds its taxes. Government budget deficit occurs View the full answer.

Lowers consumption in both the short run and the long run. Foreign 62 trillion. This includes both debt to internal creditors as well as to foreign banks or other countries.

In June 2018 China owned 118 trillion of US. Government Debt means the total gross debt at nominal value. 3 Negotiable government debt takes the form of long term bonds intermediate term notes short term notes known as treasury bills.

The national debt is the debt owed by the federal government. The national debt is best described as The Clinton administration During which of the following administrations did the US. According to the traditional viewpoint of government debt a tax cut without a cut in government spending.

Thats more than one-third of foreign holdings.

Uk National Debt Economics Help

Uk National Debt Economics Help

No comments for "The Government Debt Is Best Described as"

Post a Comment